Disaster Assistance & Business Continuity Training

Are you prepared to stay in business?

Imagine stepping into your store, or restaurant, or the office where you run your business a day or two after the tornado has passed, floodwaters have receded, or the oil has been cleaned up. Unfortunately for thousands of business owners across Alabama, this scenario is more than just imagined. It’s a reality that leaves them to deal with the heartbreak of picking up the pieces in the aftermath of a disaster, and with a whole host of unanswered questions. The Alabama SBDC Network has determined that the best strategy to help minimize the impact of disasters on Alabama’s small business community involves A) getting the word out, and B) providing basic education and guidance on the simple steps that businesses can take to protect themselves.

Up to 40% of businesses affected by a natural or human-caused disaster never reopen.

Help us change this statistic.

Contact your agent to find out if your coverage is right for your business, and make sure you understand the policy limits. Ask about Business Interruption Insurance, which compensates you for lost income and covers operating expenses if your company has a temporary shutdown. Do your insurance values reflect inflation costs over time? Do your policies cover actual cash value or replacement cost? Do you understand deductibles, waiting periods before coverage begins, and procedures for notification of insurers when a loss occurs?

If all your vital external vendors and suppliers are local, the disaster that strikes you will also strike them, and each of you will struggle to recover. Diversify your list of vendors to include companies outside your local area, if possible. Create a contact list for contractors and vendors you plan to use in an emergency, and find out if those suppliers have a recovery plan in place. File this list with other important documents in an off-site location that’s accessible and protected.

Do some advance research for alternate locations should a disaster force you to relocate. For example, contact a local real estate agent to get a list of vacant office space or make an agreement with a neighboring business to share space if needed. Establish a plan for employees to telecommute until you rebuild.

Need someone to guide you through the preparation or recovery process?

Contact one of our business advisors for a no-cost Business Impact Analysis and some objective advice. We’re not here to sell insurance, and we’re not here to burden you with regulations; We just want one more small business to survive the next disaster. We can help with risk mitigation strategies, an insurance coverage review, and continuity planning. Too late for planning? Have you already been impacted? Our business advisors can walk you through the recovery options available from FEMA, SBA, and others (depending on the type and severity of the disaster).

Helpful Resources

I Plan to Stay in Business

Download the Alabama Guide to Disaster Planning & Recovery for Small Business below (100 page workbook).

Managing in Times of Financial Difficulty

Regardless of the causes, small businesses need to take action when the going gets tough. While there is no single cure-all, there are many steps a business owner can take to manage through the difficult times and position the business for future growth.

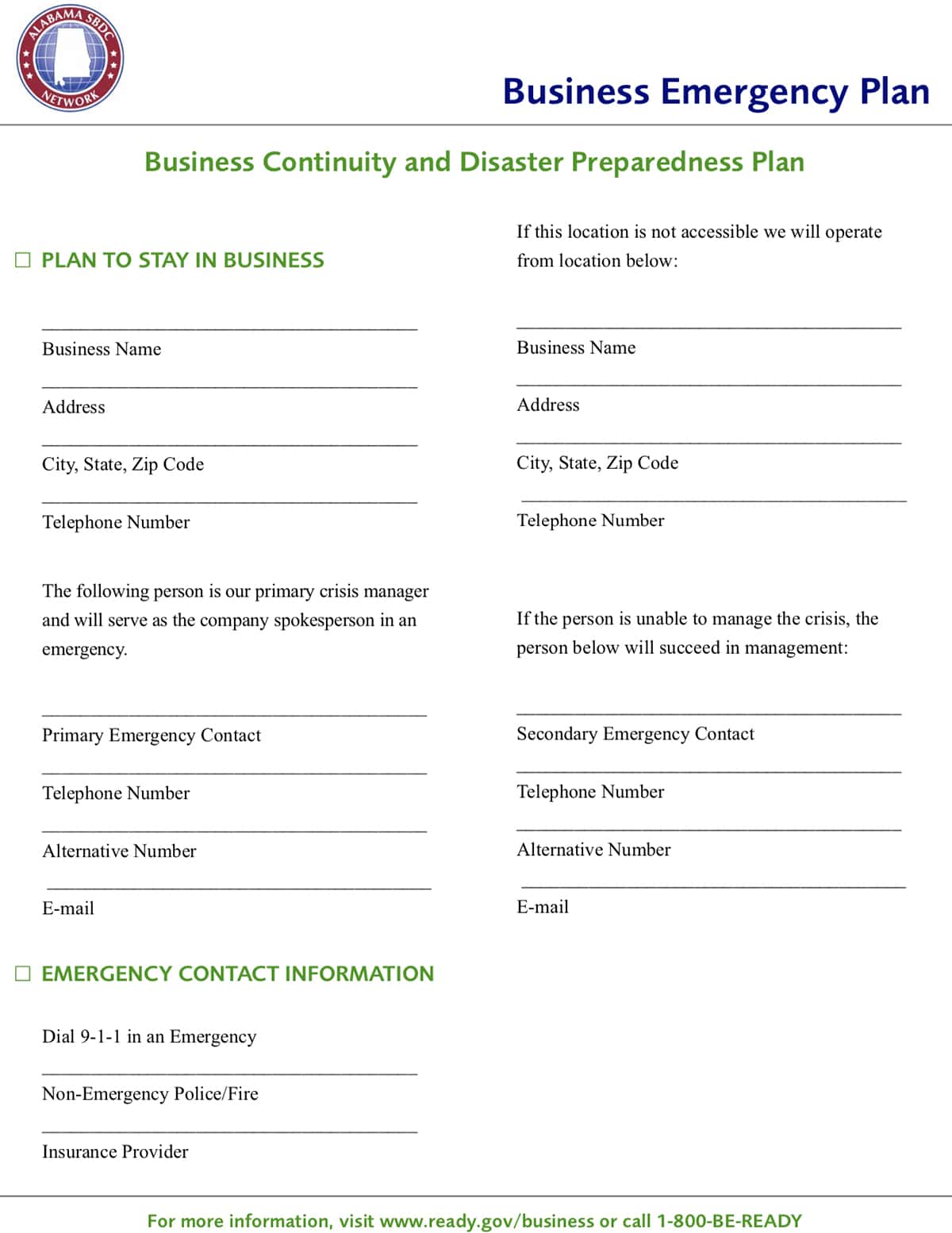

Alabama Business Emergency Plan

Do you need a quick reference guide that can be easily shared with employees? The Emergency Plan is a short and simple guide that can be used by any employee.

To download the PDF’s above, please fill out this form and select which file you wish to download.

Note: This is NOT the registration form. If you would like to talk with a Business Advisor, please complete the online Client Registration Form.